The Middle Score: Your Key to HomeownershipIdentity Theft Tricks Part One of Many

- May 3, 2024

- Posted by: Speedy Credit Repair

- Category: Credit Education

Breaking The Mortgage Code:

As you start searching for the perfect mortgage for your dream home, understanding the meaning of the “Middle Score” is paramount. Let’s dive into what it means, why it matters, and how you can leverage it to your advantage.

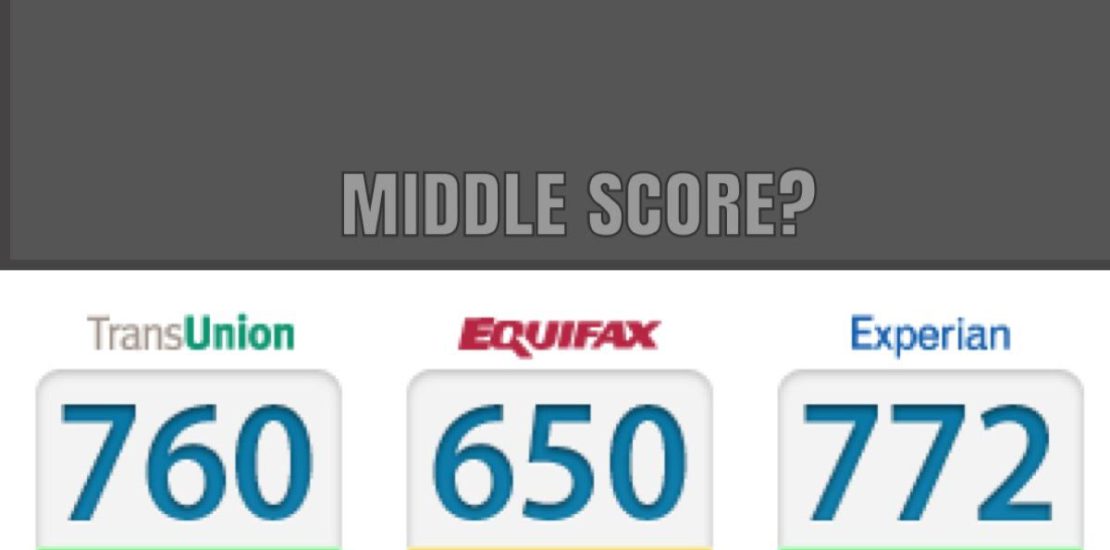

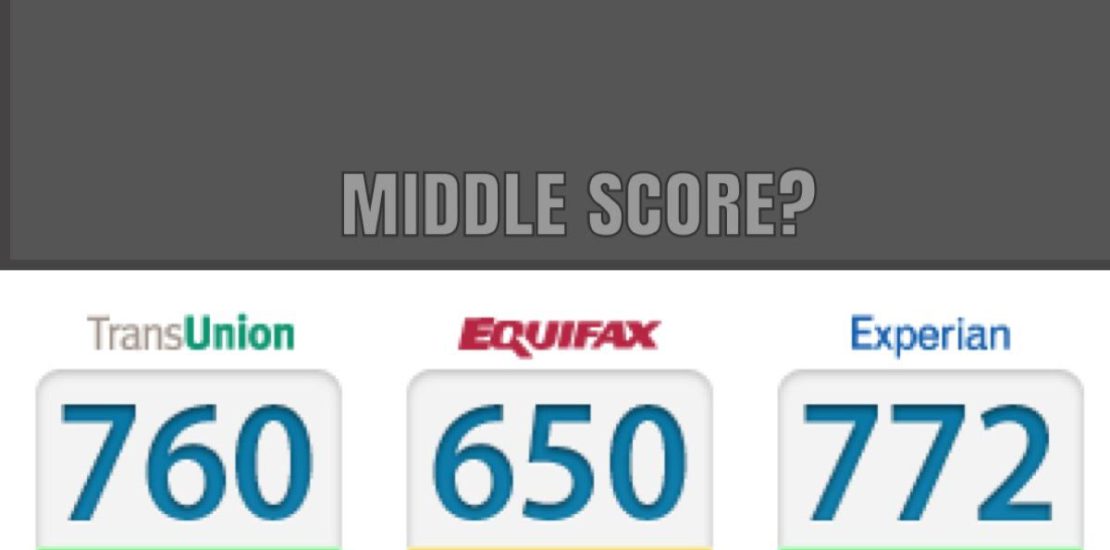

What is the Middle Score?

When lenders assess your creditworthiness for a mortgage, they typically look at your credit scores from the three major credit bureaus: Equifax, Experian, and TransUnion. Your middle score is exactly what it sounds like – the middle value among these three scores. This score is crucial because it gives lenders a snapshot of your credit health and helps them determine the terms of your mortgage.

Which FICO Model is Used?

Lenders commonly use FICO scores to evaluate borrowers’ creditworthiness. There exist various versions of the FICO model, such as FICO Score 8, FICO Score 9, and specialized mortgage-specific models like FICO Score 5 or FICO Score 4, the specific model used may vary depending on the lender’s preferences. Notably, Fannie Mae and Freddie Mac, major players in the mortgage market, typically use models like FICO Score 2, 4, and 5 from Experian, TransUnion, and Equifax respectively.

Why Do I Care if Fannie Mae or Freddie Mac Like My Scores?

Fannie Mae and Freddie Mac are government-sponsored enterprises (GSEs) that play a critical role in the U.S. housing market. They purchase mortgages from lenders and package them into mortgage-backed securities (MBS) which are soon sold to investors. By doing this, Fannie Mae and Freddie Mac provide liquidity to the mortgage market, making it easier for lenders to offer competitive rates and terms to borrowers.

Here’s why their preferred scoring models matter: Many mortgage lenders originate loans intending to sell them to Fannie Mae or Freddie Mac on the secondary market. These mortgages are called “conforming loans” because they meet (conform to) the eligibility requirements set by Fannie Mae and Freddie Mac. These requirements include minimum credit score standards based on their specific FICO models.

So, if your middle score falls within the range preferred by Fannie Mae and Freddie Mac for your loan type, it increases the chances of your loan being considered a conforming loan. This makes your loan more attractive to a wider range of investors and potentially translates to better interest rates and terms from your lender.

Creative Ways to Boost Your Middle Score

Improving your middle score doesn’t have to be an elusive dream. Here are some creative strategies to help elevate your creditworthiness:

- Pay Bills Promptly: Timely payment of bills, including credit card balances and loans, demonstrates responsible financial behavior and positively impacts your credit score.

- Reduce Credit Utilization: Aim to keep your credit card balances low relative to your credit limits. This can lower your credit utilization ratio and boost your score.

- Diversify Your Credit Mix: Like a recipe, you need a healthy mix of credit types, such as credit cards, installment loans, mortgages, and auto loans to create a positive influence on your credit score.

- Address Errors on Your Credit Report: Regularly review your credit report for inaccuracies or errors that may be dragging down your score. Correcting these discrepancies can lead to score improvements.

- Become an Authorized User on a Low-Utilization Credit Card Account: Being added as an authorized user on a credit card with a good payment history and low balance can improve your score, especially if your credit history is limited. (Speedy Credit Repair suggests you reach out before doing this). There is a right and wrong way here. We will help!

Understanding the Impact of the Middle Score

Your middle score plays a significant role in determining the terms of your mortgage, including the interest rate and any points charged for the loan. While a minimum credit score is typically required for approval, lenders consider other factors beyond your credit score, such as your provable income, current debt obligations, and previous credit history (even if resolved).

A higher middle score translates to potentially lower interest rates and points, saving borrowers significant money over the loan term. For instance, a small improvement in your middle score could result in thousands of dollars saved throughout your mortgage.

How We Can Help

At Speedy Credit Repair Inc., we understand the complexities of credit and the importance of a strong credit profile when securing a mortgage. Our team of experts is here to assist you in improving your credit health and increasing your middle score. Whether you need help addressing errors on your credit report, developing a personalized credit improvement plan, or navigating the mortgage approval process, we’re here to support you every step of the way. It’s important to note that while Speedy Credit Repair helps improve credit scores, we cannot guarantee specific score increases or loan approvals.

In Conclusion

Understanding the significance of the middle score in mortgage hunting is essential for aspiring homeowners. We empower individuals like you to take control of their credit and achieve their homeownership goals. By implementing proactive credit improvement strategies and seeking assistance from trusted professionals like Speedy Credit Repair Inc., you can get closer to securing the home of your dreams.

Keywords:

Credit Repair, Best Credit Repair, Credit Education, Speedy Credit Repair, Build Credit, Remove Hard Inquiries, 800 Fico Score, 800 Credit Score

Fix Your Credit Today!

Speedy Credit Repair works on the “Pay As We Perform” platform. No setup fees or additional costs for credit review or consultation. You only pay as we perform!